working capital funding gap

Even if the terms are equal there could still be gaps or delays between the time an expense incurred needs to be paid and when the revenues related to the incurred expense get collected. Apply Now Back to deal.

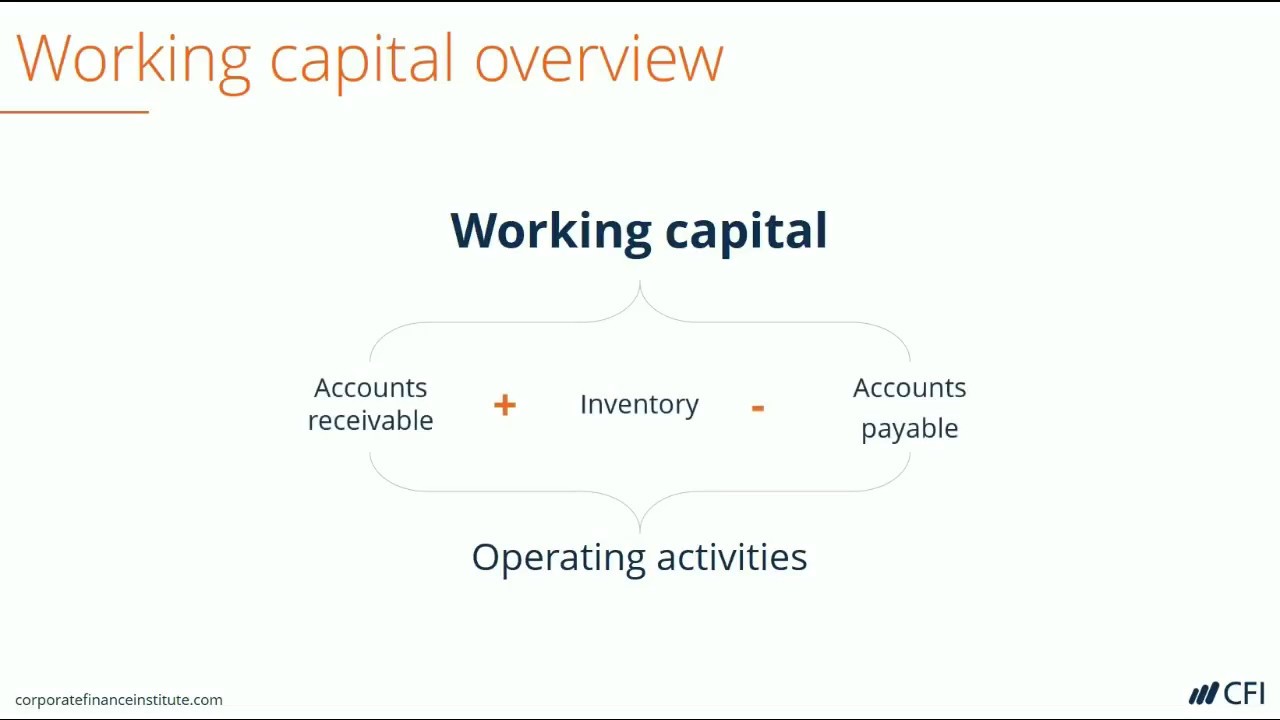

Working Capital What Is Working Capital Youtube

Receivable days 20.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

. Gap Funding can make all the difference with your successes in real estate. Working capital finance Navigating the landscape. It can also be defined as Long term sources less long term uses.

Yes Ive made money in real estate utilizing none of my own money many times There are 3 views. 4Keep more inventory on hand. Whats the companys working capital funding gap in days based on the information below.

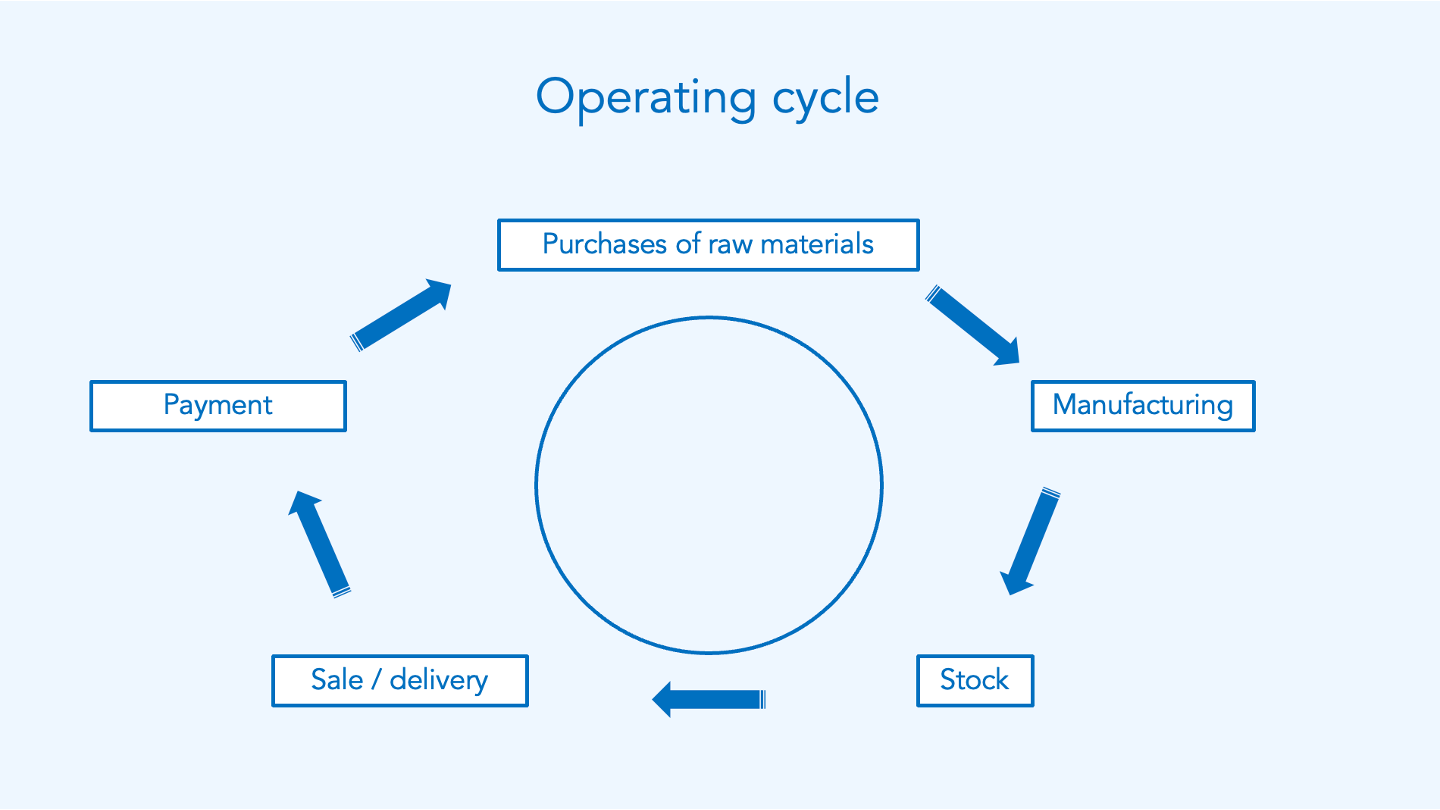

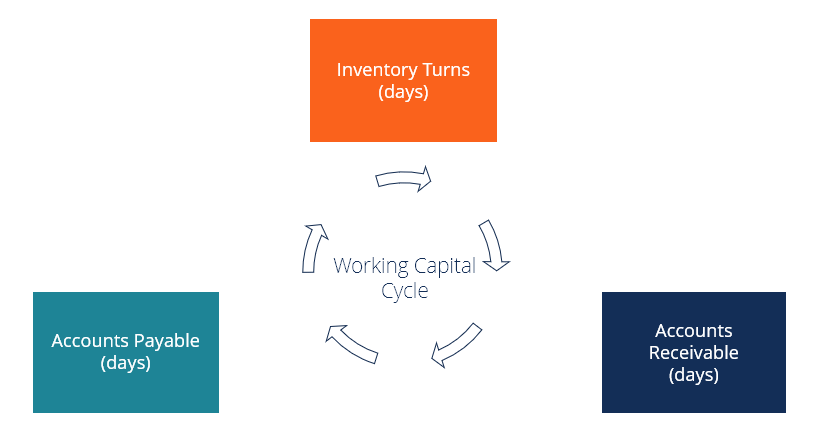

Working Capital Cycle 85 20 90 15. Working capital refers to the assets owned by a company against its liabilities and is a measure of its financial health. Negotiate the contract with suppliers to be able to delay the payments.

1Extend credit for customers. Working capital shortages can be created from a number of different business events. Days working capital 73 days.

The cash gap drops to only 40 days even if management does nothing to change the collection or payables periods. The days working capital is calculated by 200000 or working capital x 365 10000000. However if the company made 12 million in.

Stockpile the inventory and make sure they are not out-of-stock. We recognize that all business owners need an injection of capital at different time and for different reasons to keep the business running and growing. We offer a wide variety of products and constantly look to add to our program offerings.

Find out how banks can bridge the gap by leveraging new technologies and take advantage of delivering a unique and differentiating proposition in the market. It can be shown as. As we have seen above this approach reduces the finance cost as interest rates tend to be cheaper and its flexibility allows the business to only use the facility when needed.

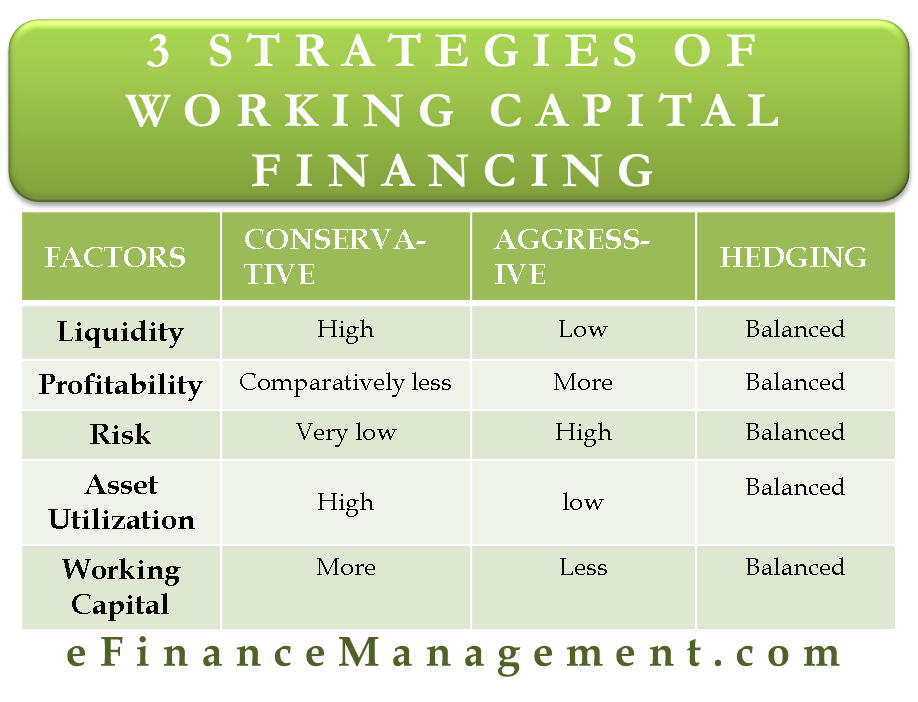

Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. 90 days 90 20k invested x 90 18k 38k paid back. An aggressive working capital financing approach seeks to reduce the financing cost by using short term funding sources to finance both permanent and temporary working capital.

When people say you can make money in real estate without using any of your own money its almost true. Working capital funding gap calculation Sunday April 3 2022 Edit. Inventory days 85.

Working Capital Cycle Formula. This inventory reduction leads directly to a drop in annual interest cost of 48 million 50 days 3 96000 per day. Shrinking the cash gap is good for the bottom line.

Working Capital Gap. Working capital gap is the excess of current assets as per stipulations over normal current liabilities other than bank assistance. Now that we know the steps in the cycle and the formula lets calculate an example based on the above information.

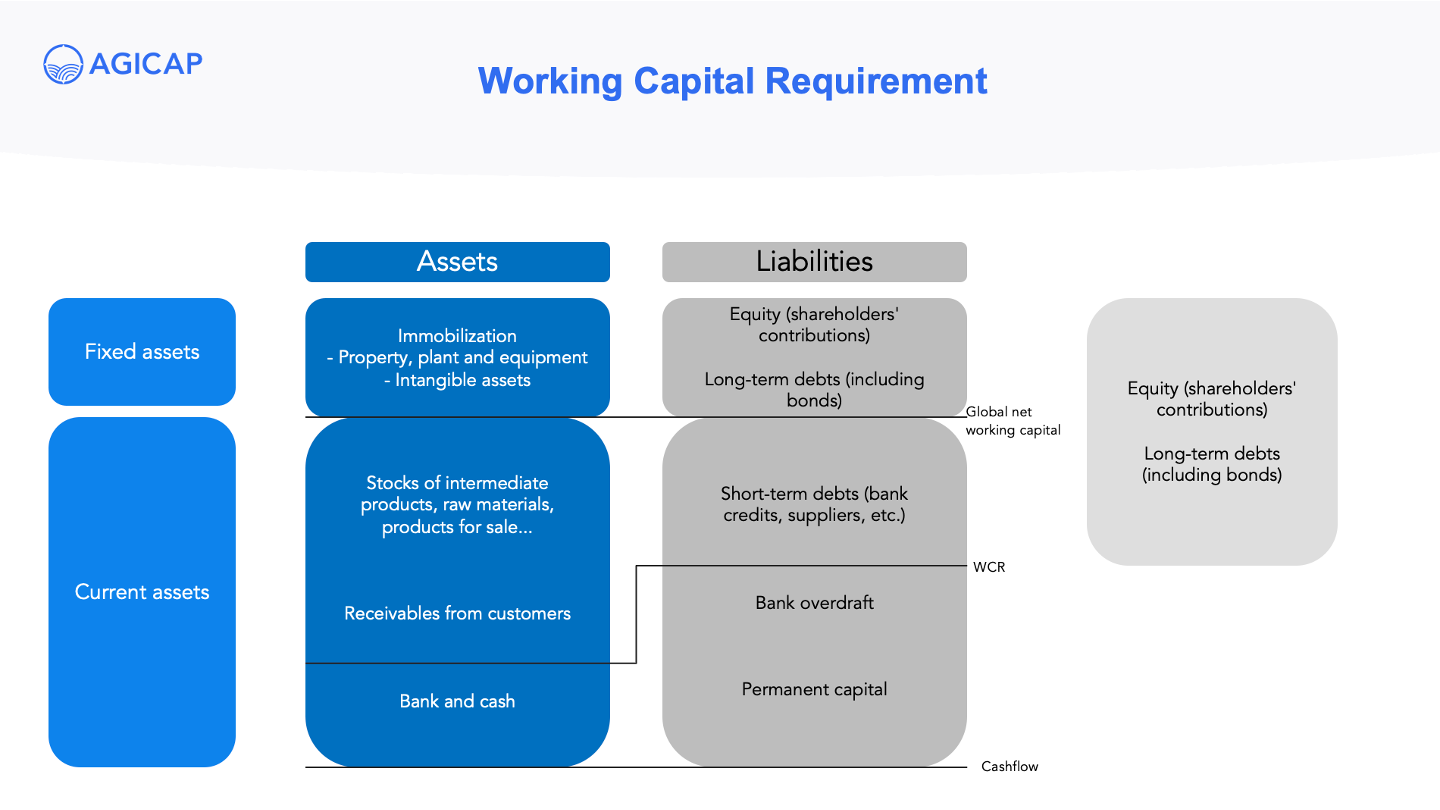

Working Capital is a general term for commercial financing. What Is Gap Funding. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities.

Which of the following strategies is most likely to shorten the working capital funding gap. It can also be described as Long term sources few long term uses. Working Capital Cycle Sample Calculation.

Working capital gap Current assets. What actions could a company take to reduce its working capital funding gap. Payable days 90.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. The entire reduction stems from better inventory control.

Based on the above steps we can see that the working capital cycle formula is. Calculation of Days Working Capital. The working capital gap in simple words is the difference between total current assets and total current liabilities other than bank.

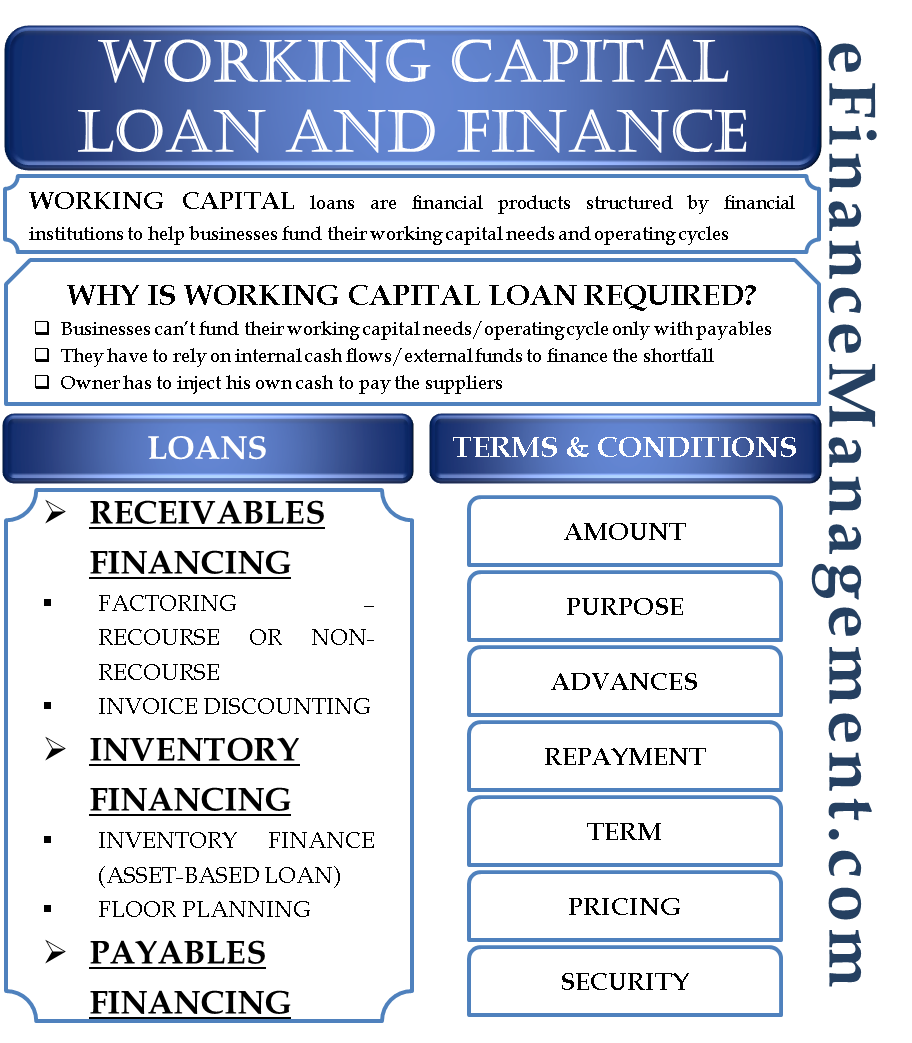

A decline in sales an increase in past due receivables a temporary increase in labor and any number of inventory turnover problems can lead to a short-term financing gap. Allow customers to delay payments. This type of financing assistance by banks was introduced on the basis of.

2Extend payment to suppliers. Compare 2021s Top Online Working Capital Lenders. Knowing the working capital requirements of ones company is crucial for making business decisions.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a. Current assets minus current liabilities are equal to the Working capital gap. 3Provide discounts for customers.

From global corporate bank alignment risk vs relationship the change in technology and implication of cloud. If you are an entrepreneur or if you want to be a successful entrepreneur you should consider working with a funding source that can provide you the working capital investment capital venture capital seed money startup funding equity funding personal loans small business funding gap loans small business loans bridge financing funding for startup businesses. We have developed Arviem Working Capital Financing Solutions to help to bridge the funding gap by using our independent cargo monitoring and partnerships with agreed banks who acquire your assets whilst in the supply chain.

Bank assistance for working capital shall be based on the working capital gap instead of the current assets need of a business. The working capital calculator is an easy-to-use online tool that allows businesses to determine how much surplus cash they need to keep running. Go to the LendingTree Official Site Get Offers.

Raise the price of the products to increase revenue. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. Your current ratio will give you an idea if you have enough working.

Everything You Need To Know About Working Capital

Working Capital Cycle Efinancemanagement

What Is Working Capital Gap Banking School

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Compare 3 Strategies Of Working Capital Financing

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Requirement Wcr Agicap

Working Capital Requirement Wcr Agicap

Working Capital Requirement Wcr Agicap

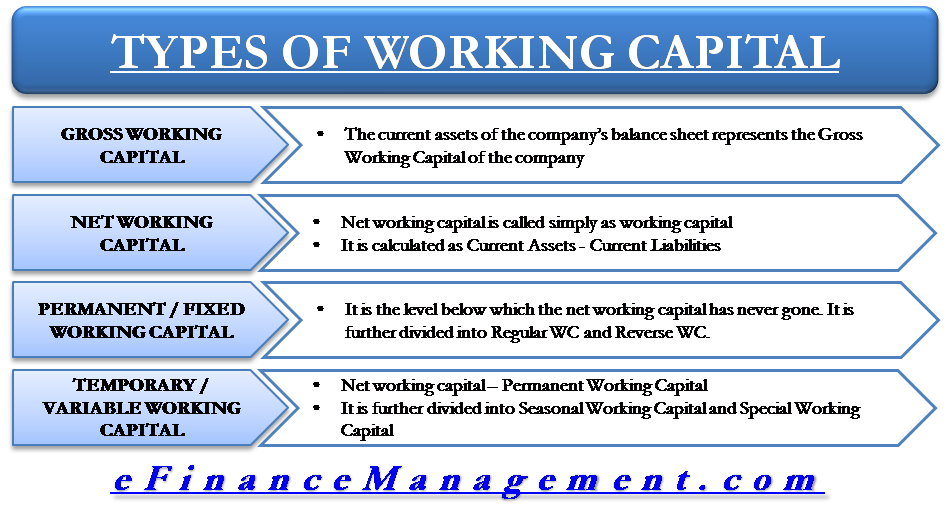

Types Of Working Capital Gross Net Temporary Permanent Efm

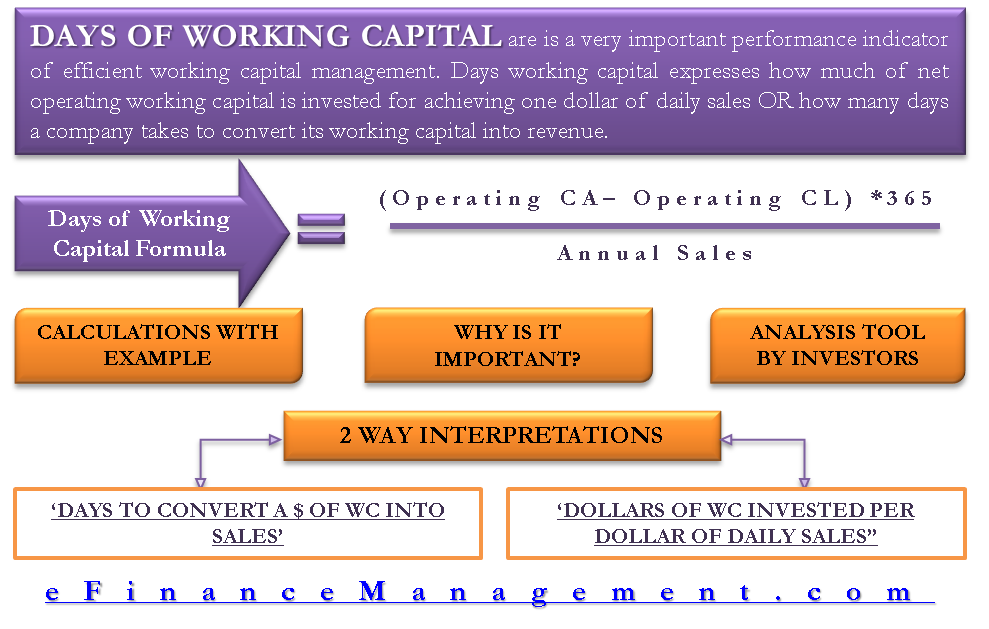

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What Is Working Capital Youtube

Working Capital Cycle Definition How To Calculate

Working Capital Calculator Kredx

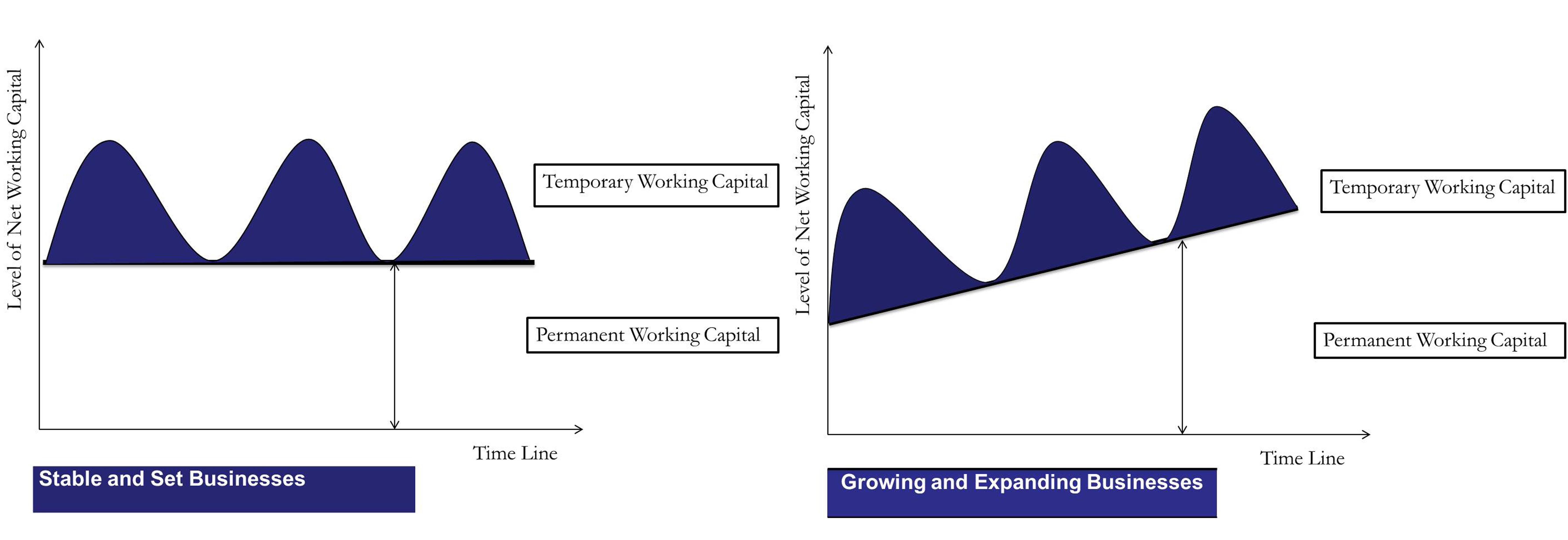

Permanent Or Fixed Working Capital

Working Capital Formula Youtube

Working Capital Loan Finance Types Terms Conditions Requirement

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)